New Study Shows How Much Inflation Is Hurting Small Restaurants

The inflation that has taken hold this year serves as a second punch delivered to the restaurant industry that is still reeling from the aftereffects of the coronavirus pandemic. Even before Russia invaded Ukraine, Restaurant Business was reporting that restaurant menu prices were hitting a 40-year high. This included both quick service restaurants like McDonald's, which saw their menu prices grow by 8% between January 2021 and January 2022, as well as traditional sit-down establishments, which saw a rise of 7.1%.

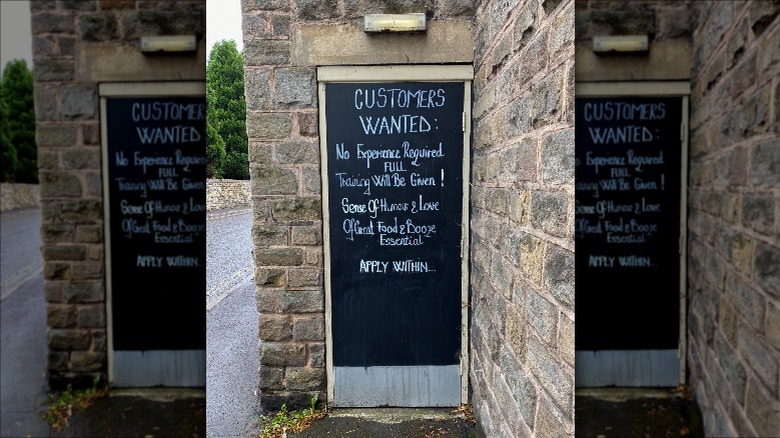

These higher menu prices are occurring at a time when labor is pushing for better compensation and the cost of general groceries and gas is high. On August 5, Axios revealed that many restaurants are attempting to win over customers with promotions that directly address the current inflation. "We get it! Rising inflation is driving up the costs of gas and everyday items," a promotion from Denver's Little India reads. So, people were treated with a $10 all-you-can-eat lunchtime buffet throughout July. Others establishments offered $15 off and $7 for seven item deals.

This has had a disastrous effect on small restaurants

These efforts to attract customers at a time when people are carefully budgeting have not proven successful. A survey shared with Restaurant Dive found that 66% of small independent restaurants saw a decrease in sales, and noted that 72% of restaurant owners expect their establishments to close unless inflation eases.

However, the survey also notes that McDonald's experienced a 3.7% growth in sales in the second quarter. This is despite the fact that the chain also raised prices. Chipotle could report the same with a 10.1% sales growth in the same period.

This isn't exactly novel though. In October of 2020, The Food Institute covered the same trend during the fallout of the pandemic's first wave. Chipotle tripled sales and McDonald's enjoyed a growth of 4.6%, which included the best growth month in a decade with a double digit growth in September. During all this, Yelp shared, via The Food Institute, that about 75% of all the restaurants that closed during the beginning of the pandemic had fewer than five locations.

Chains simply have larger budgets, a business model geared for home consumption, and a fiercer grasp over the public's palate than their restaurant counterparts. So they are positioned to succeed in an environment that would doom traditional dining.