One Supermarket Reigns Supreme For Overall Foot Traffic

In 2019, Aldi was set to overtake all of its competitors in the budget supermarket industry. "I never underestimate them," Greg Foran, Walmart's CEO, said in a conference call quoted by CNN. "I've been competing against Aldi for 20-plus years. They are fierce and they are good." Data showed that during the second half of 2018, a Walmart in Houston attempted to match the prices offered by Aldi, but could not close the gap. In fact, they had to bring prices up by the end of the year.

More recently, a press release Numerator shared with the Associated Press on August 1 revealed that the two companies were trading titles in the private label arena as well. Aldi had the largest percentage sales of private labels with 77.5% while only 23.3% of sales at Walmart were private labels. No doubt the massive focus on private labels is part of why Aldi cannot be matched in low prices. However, four of the five the biggest private label brands belonged to Walmart. These are Great Value, Equate, Marketside, and Freshness Guaranteed. So, despite some worried glances at Aldi, Walmart managed to maintain a grip on consumer loyalty.

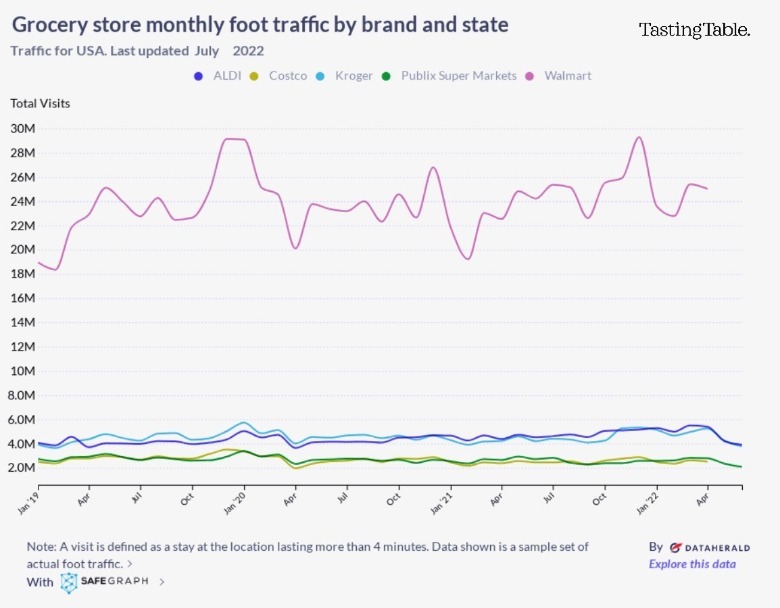

The vast majority of people walk into Walmart

When it comes to foot traffic, Walmart is by far the most dominant. According to the geospatial analytics company SafeGraph, the amount of physical visits to a Walmart location that lasted for more than four minutes never dipped below 18 million between January 2019 and April 2022. All of Walmart's competitors — even the fervent fanbase-inspiring Aldi — failed to attract more than 6 million of such minutes for any month during that entire time.

However, foot traffic is not everything. Reuters reported in July that Walmart had to lower its profits forecast as customers began to alter their shopping habits under the new prices for food and fuel. The company expects profits to drop by 11% to 13%, over ten times more than the previously estimated 1%. "Walmart is a lot more susceptible to the lower-income customer, and that lower-income customer is the one that is suffering the most under the higher inflation levels," Brian Yarbrough, an analyst at Edward Jones, explained. Still, customers will spend more for essential fuel and foods even as more frivolous purchases decrease. So Walmart has raised growth predictions to 6%. Even with the layoffs of 200 corporate workers, as covered by Industry Leaders Magazine, Walmart may still maintain an edge of Aldi — for the moment anyway.