The US Beer Industry Is In Hot Water After New Report

The Treasury Department has published a report on its findings on how competitive the beer, wine, and spirit markets actually are. For the beer industry, it could mark the beginning of a radical shift.

When it comes to beer, the report noticed two major trends. First, the number of craft breweries grew from 89 in the 1970s to over 6,400 today. The second trend, however, is that even with the boom of smaller craft makers, the beer industry has consistently consolidated to the point that just two breweries now own 65% of the market's revenue. In other words, the business has developed toward an oligopoly.

For anyone watching the industry, though, the Treasury's report isn't really news. By 2012, the beer market was already controlled by four companies: AB InBev, SABMiller, Heineken, and Carlsberg. As The Week explained (in 2017), this group at the time already controlled nearly 75% of U.S. sales, not to mention 47% of the global market. Then, in 2016, AB InBev and SABMiller merged.

The concentration of brands under so few corporate umbrellas reduced competition across the industry, allowing for the rise in beer prices. More worrisome, AB InBev began (in 2017) to buy stakes in beer review sites like RateBeer through its own venture capital company (via VinePair). In other words, the beer industry has been trending in this oligopoly direction for quite some time now, and the Treasury's report today merely confirms this trajectory.

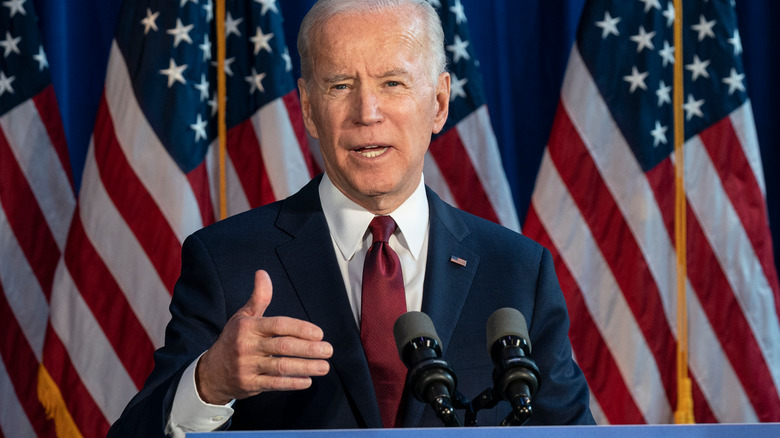

The Biden Administration has promised competition

The context for this report is that the Biden administration has publicly made a commitment to improve competitiveness in the American economy.

An executive order authored in July gave a mission statement of how it will address the consolidations that have occurred across various markets to the determinant of Americans who want to participate in the economy. What that means for the beer industry is that the consolidation is seen as harmful to consumers as they pay higher prices for less meaningful choices and to entrepreneurs who want to brew their own batches. The most important consequence of this is that, theoretically, the big breweries that dominate the market could be broken up by antitrust laws.

The Brewers Association, which represents small and craft breweries, welcomed the findings of the report. They agreed with the conclusions drawn from the report but still mentioned that concluding that the market has consolidated and implementing measures to break up dominant companies and to spur smaller businesses is a different step.

However, a somber note should be kept here as the report ends on one, too. It poses the question of "the extent that regulators are separated from the influence of industry." Regulators can either enforce rules or grant licenses. The latter can lead to corruption which could also explain current consolidation. It's up to the Biden administration to decide how regulation should work.