The Italian Bank Where You Can Use Parmigiano-Reggiano Cheese As Loan Collateral

When some customers of the Credito Emiliano bank need to make a withdrawal, they're certainly not using the drive-thru. Credito Emiliano, which Forbes notes is locally referred to as Credem, is located in Northern Italy's Emilia Romagna region, inside of which are the only five provinces where the famed Parmigiano-Reggiano cheese can be produced, according to Eataly.

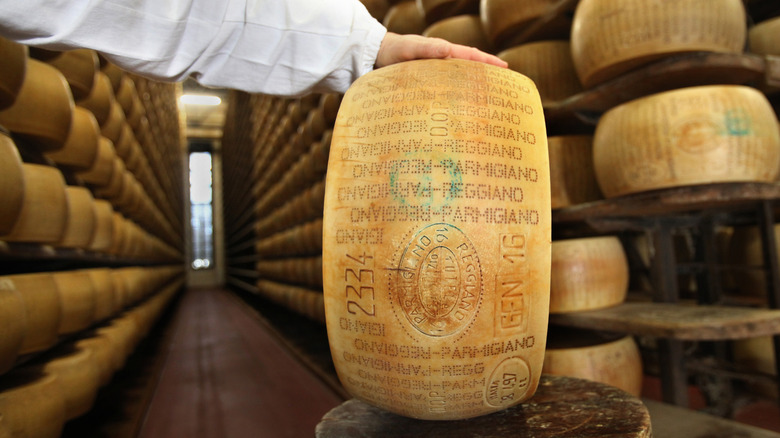

The process of making this particular type of cow's milk cheese is a long and arduous one, requiring dedication, patience, and significant financial resources. Eataly explains that it takes around 140 gallons of milk to make a single wheel of Parmigiano-Reggiano, which ends up weighing about 100 pounds. Further, Parmigiano-Reggiano must legally be aged for a minimum of 12 months and is often aged for up to 36 months, during which time the cheese has to be rotated and cleaned on a weekly basis. Not only does this make storage for the enormous wheels of cheese a challenge — it also means that keeping a family-owned cheese business afloat while the cheese is aging can create a financial crunch.

It's not that cheese makers don't have resources; it's just that it takes a long time for those resources to become liquid — in a solely financial sense, of course. Thankfully, Credito Emiliano came up with a creative answer to this issue.

Credito Emiliano devised a tasty solution

There are a multitude of small cheese-producing businesses in the Emilia Romagna region like the one owned by the Caretti family, who told CNN they've been producing cheese since 1925. While these businesses vary in size, they share a common need for both storage of these wheels of cheese — the Caretti family produces 12,000 a year — and also funds to keep them afloat before they sell that cheese. Credem has built a business that can fulfill both needs.

CNN explains that Credem extends a low-interest loan, and their subsidiary, Magazziini Generali delle Tagliate, provides climate-controlled storage and inspection for hundreds of thousands of wheels of the valuable Parmigiano-Reggiano, according to Forbes. Lending cheesemakers funds while holding young Parmigiano-Reggiano cheese as collateral is a practice that Forbes points out Credem began in 1953. This service ties the bank to its local community and customers.

Though lending cash for crumbly cheese only makes up about one percent of the bank's business, it integrates (bad cheese-grating pun unintended) Credem into the lives and work of the region's residents.